Request Payment

Request Payment – The New Standard for Real-Time Digital Invoicing

Request Payment (RfP) is redefining how merchants, platforms, and service providers send and receive digital invoices. Using FedNow® and RTP®, RfPs deliver structured, real-time requests for one-time or recurring payments, built with rich data and processed instantly through U.S. financial institutions.

Replace Paper Invoices with Real-Time RfPs

Legacy invoices are slow, error-prone, and increasingly outdated. With digital transformation accelerating across all industries, Request for Payments (RfPs) have emerged as the new digital invoice format—delivered via email, SMS, paper, or mobile notifications.

Each RfP includes full ISO 20022 rich data, allowing for accurate reconciliation, alias-based routing (email or phone), and seamless real-time settlement.

Whether you are billing once or on a recurring basis, the RfP system gives you:

- Guaranteed, irrevocable good funds

- Instant credit delivery to the payee’s account

- Complete audit trail for every transaction

- Recurring “debit-style” flows without manual interaction

- Compatible file formats: ISO 20022 XML, .XLS, .CSV, HTML

Key Features of Request Payment (RfP) Invoicing:

- Instant delivery and payment via FedNow® or RTP®

- Works with all U.S. banks and credit unions

- Alias routing via SMS, mobile, email, or app

- Structured metadata for billing, accounting, and automation

- Automated recurring billing supported

- Real-time reconciliation and RfP aging tools included

- Uploadable and downloadable through payee dashboards

- Supported for B2B, C2B, and subscription businesses

Creating and Sending a Request Payment File

A Request Payment file can be created using Excel, CSV, or ISO 20022 XML to suit your business’s workflow. These files are structured with:

- Payee and payer alias (email or mobile number)

- Amount due, currency, and scheduled date

- Recurrence details (static or variable)

- Invoice reference and notes

- Hosted Payment Page link or QR code

- FedNow® or RTP® routing data

Once created, the file is uploaded to a FedNow®- or RTP®-enabled dashboard. From there, RfPs are distributed through secure payment channels. Payers approve the request in their banking interface, and the funds are credited to the payee in real time—confirmed and settled.

Managing Aging RfPs and Bank Reconciliation

As RfPs are sent, aging data is automatically tracked by the dashboard, giving you visibility into outstanding, completed, and failed payments.

Features include:

- Real-time AR aging reports: 1–30, 31–60, 61–90+ days

- Return and reject code tracking with error details

- Excel download for CFOs, bookkeepers, and controllers

- Auto-updated RfP statuses: Paid, Rejected, Expired

- Alias-by-alias payment performance insights

- Built-in reconciliation tools for both FedNow® and RTP®

- No chargebacks, no guesswork, no batch delays

Recurring transactions, though credited from the payer, functionally behave like digital debits, initiated by the payee, and processed on a set schedule. These are especially useful for utility companies, SaaS providers, lenders, or subscription-based platforms.

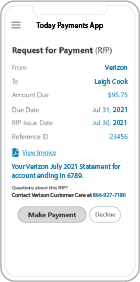

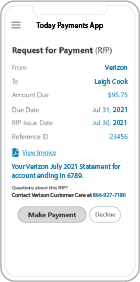

Requesting payment from a payer to a payee through real-time payment systems can be executed via various channels, including digital platforms, texting, or traditional paper invoicing methods. Here's how each of these approaches can work:

- Digital Invoicing and Payment Requests

- The payee generates an invoice digitally through an invoicing platform or accounting software, detailing the amount owed, invoice number, due date, and any other relevant information.

- The invoice includes instructions for payment, such as bank account details or a link to initiate payment through a payment gateway.

- The payee sends the invoice to the payer via email or through the invoicing platform.

- The payer receives the digital invoice and can initiate the payment directly through the provided payment link or by logging into their account on the invoicing platform.

- Payment is processed through the chosen real-time payment system, such as RTP or FedNow, with funds transferred instantly or within minutes from the payer's account to the payee's account.

- Texting Payment Requests

- The payee sends a payment request to the payer via text message, including details such as the amount owed and instructions for payment.

- The payment request may contain a link to a payment portal or instructions for initiating payment through a designated method, such as mobile banking.

- The payer receives the text message and follows the provided instructions to initiate the payment.

- Payment is processed through the chosen real-time payment system, and funds are transferred instantly from the payer's account to the payee's account.

- Paper Invoicing with Real-Time Payments

- The payee generates a paper invoice detailing the transaction and includes instructions for payment, such as bank account information or QR codes linked to payment portals.

- The paper invoice is sent to the payer via mail or handed over in person.

- The payer reviews the invoice and initiates payment through their preferred method, such as online banking or mobile payment apps, using real-time payment systems.

- Payment is processed instantly or within minutes, with funds transferred from the payer's account to the payee's account through the chosen real-time payment system.

In all these scenarios, real-time payment systems enable fast and secure transfer of funds between the payer and payee, regardless of whether the payment request originated digitally, via text message, or through traditional paper invoicing methods.

Send Smart Invoices with RfP at TodayPayments.com

Ready to replace outdated invoices and ACH delays?

✅ Send structured digital

invoices using RfP files

✅ Receive real-time

payments via FedNow® and RTP®

✅

Automate recurring billing with alias-based identifiers

✅

Use Excel, CSV, XML, or ISO 20022 formats

✅ Access

real-time reconciliation and AR aging—for free

Start using Request for Payment invoicing

today at

https://www.TodayPayments.com

Get Paid Instantly.

Invoice Smarter. Reconcile in Real Time.

About Request Payment

RfP FedNow Request for Payment is a payment solution offered by the Federal Reserve that allows for real-time payments between financial institutions. It is primarily designed for business-to-business (B2B) transactions, but can also be used for person-to-person (P2P) payments.

To use RfP FedNow Request for Payment for mobile billing, a merchant would need to have an account with a participating financial institution that offers the service. They would also need to have a way to generate payment requests, such as through an invoicing or billing software that supports RfP FedNow Request for Payment.

Once the payment request is generated, it can be sent to the customer's mobile device through a messaging app or email. The customer would then be able to review the payment request and authorize the payment using their own banking app or mobile wallet that supports RfP FedNow Request for Payment.

It's worth noting that while RfP FedNow Request for Payment is a relatively new payment solution, adoption is growing rapidly among US financial institutions. Merchants who are interested in using the service should check with their own financial institution to see if they offer RfP FedNow Request for Payment, and what options are available for generating and sending payment requests.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

Software Integration: Integrate your Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

Today Payments

...continues to meet the challenge of our clients by offering cost effective "good funds", real-time, instant, credit card, ACH and e-invoice payment processing services into the electronic payment solutions banking system. Electronic banking includes the transfer of funds between companies (B2B) and/or (B2C) consumer accounts for collection and payments. Today Payments Gateway Merchant Services gives your company choices in the method of faster payments that you can accept from your customers.

Our payment processing platform is designed for simplicity and ease-of-use.

SecureQB Cloud payment processing integration for QuickBooks ® give you the Best transaction detail information, real-time, with matching error-proof through QuickBooks.

Process with the Request Payment Professionals

- Automation of Accounts Receivable Collection with Real-Time Settlement & Deposit

- Automation of Accounts Payable Payments with Real-Time Settlement & Deposit

- One-Time & Recurring Real-Time Credits with Settlement & Deposit

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request Payment payment processing